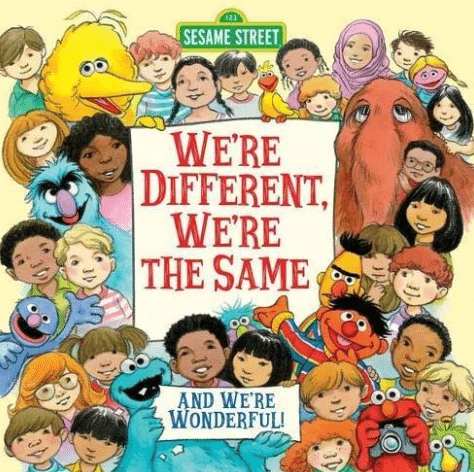

“We are different, we are the same”

We have had the good fortune over the years to work with successful business owners all across the country. And as we have heard their fascinating stories of how they built and cultivated business success, the word that best probably best describes each of their stories is “unique”.

Yet, despite their differences we consistently see a number of strikingly common themes in helping business owners develop a strategy to manage their investment portfolio. And three items in particular that would be well-advised to avoid.

Taking unnecessary risk

Most successful business owners do not view their business as inherently risky. This is typically because they have built stability of income and exercise control over the decisions that can drive business success. Because of this, along with an overall high tolerance for risk, business owners frequently take unnecessary risks in their investment portfolio and fail to have their investment portfolio risk coordinated the other components of their wealth (such as business interests, real estate, etc.). In our view, the most successful investment portfolios are always managed in coordination with one’s business and the other components of your financial life.

Prioritizing the business over personal finances

Most business owners focus, and appropriately so, on the engine that is creating their wealth – their business. In fact, it is not unusual for them to view an investment portfolio as an insignificant part of their overall financial life, and to treat it with a “set it and forget it” approach. While it may not represent a significant portion of wealth for many, relative to their business, it is important to have a strategic plan for your investment portfolio that – just like your business – is executed, reviewed and monitored appropriately.

Managing a portfolio like a business

The most problematic mistake is when business owners try to manage their portfolio with the same principles that drive success in their business. As a business owner, you might often need to make significant strategy adjustments as markets conditions change, and focus relentlessly on how to drive and grow your income over both the short and long term. These are both examples of principals that work in a successful business, but do not work in a successful investment portfolio. In fact, there are many decisions in the proper management of an investment portfolio that are contrary to basic human instincts. Investing great Warren Buffet summarized this well in recommending to be “fearful when others are greedy and greedy when others are fearful.

Despite the unique-ness we have witnessed over the years with business owners across industries, geographies and sizes, we continue to find that these similarities that hold true. We are different; we are the same. And if you happen to be curious where this quote came from (as I was after I wrote it) a “google” revealed the source. Night-time reading to my two children has left its mark!

If you would like to learn how we can seamlessly integrate your investment portfolio into your financial planning strategy, feel free to contact us.

Interested in learning more about investment insights?